Ilankai Tamil Sangam

Association of Tamils of Sri Lanka in the USA

Published by Sangam.org

by Anusha Ondaatjie, Bloomberg News, April 5, 2007

|

Costlier oil and military purchases to combat separatist Tamil Tiger rebels have fanned consumer prices, curbing growth in the island's $26 billion economy. China and India, Asia's two fastest-growing economies, are competing for overseas oil and gas reserves to meet soaring energy demand. "Escalating oil and gas prices have not only led to the increase in the cost of living but also the reduction of competitiveness of Sri Lankan exports,'' the Ceylon Chamber of Commerce, the island's biggest industry grouping, said in a statement. "The oil and gas industry has the potential to change the destiny of Sri Lanka.'' |

|

| Economist, April 2007 |

Sri Lanka, a country that imports all its oil, will next month ask explorers to compete to develop a field that may contain 1 billion barrels of crude, 17 percent of neighboring India's reserves.

China and India's state oil companies have already been promised two of the Mannar basin's five blocks. Sri Lanka will seek bids to develop three remaining areas on May 1, said Neil De Silva, director general of petroleum resources development. Licenses will be awarded in early 2008, he said yesterday.

Sri Lanka needs to secure its own oil supplies to reduce petroleum imports. Costlier oil and military purchases to combat separatist Tamil Tiger rebels have fanned consumer prices, curbing growth in the island's $26 billion economy. China and India, Asia's two fastest-growing economies, are competing for overseas oil and gas reserves to meet soaring energy demand.

``Escalating oil and gas prices have not only led to the increase in the cost of living but also the reduction of competitiveness of Sri Lankan exports,'' the Ceylon Chamber of Commerce, the island's biggest industry grouping, said in a statement. ``The oil and gas industry has the potential to change the destiny of Sri Lanka.''

Demand for fuel is rising in line with economic expansion, projected at 7.5 percent this year. Oil prices in New York have risen 5.4 percent this year to trade at $64.35 a barrel today.

West Coast

The auction for the three remaining blocks in the basin off Sri Lanka's west coast will be launched at an offshore technology conference in Houston on May 1, De Silva said in a telephone interview yesterday. Bids will be open until early November, he said.

China National Offshore Oil Corp., parent of overseas- listed Cnooc Ltd., may develop one coast, Petroleum Minister A.H.M. Fowzie said in an interview in Shanghai on March 1. The basin contains the equivalent of one billion barrels of oil, he said. The Beijing-based company may start exploration off the Sri Lankan coast by 2008, he said.

``A block will also be going to the government of India,'' De Silva said. India had proved oil reserves of 5.9 billion barrels at the end of 2005, according to BP Plc's Statistical Review of World Energy.

China's Help

The Chinese government is helping Sri Lanka build its first coal-fired power plant at Norocholai, north of capital Colombo, as the island seeks cheaper electricity. The plant will produce 300 megawatts by 2010 and as much as 900 megawatts as demand rises. The electricity will cost half that of an oil-fired unit.

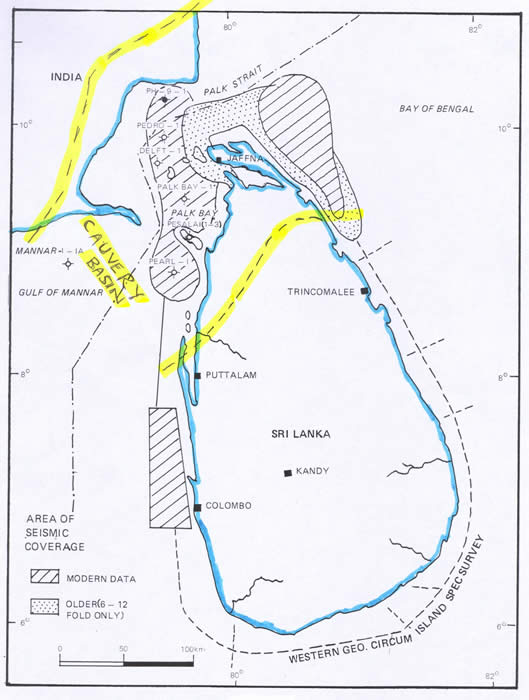

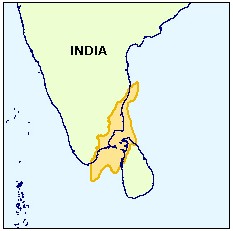

Sri Lanka Oil Exploration Map Showing Cauvery Basin (yellow lines shows boundaries of Cauvery Basin on land, see map below), October, 2003, Sharp IOR eNewsletter. "...there is a resurgence of interest in offshore exploration in Sri Lanka, after a lapse of about 20 years. The main impetus is the success achieved on the Indian side of the Cauvery Basin, which straddles India and the north of Sri Lanka, where fields are in production and a significant discovery has been made close to the median line."

Sri Lanka Oil Exploration Map Showing Cauvery Basin (yellow lines shows boundaries of Cauvery Basin on land, see map below), October, 2003, Sharp IOR eNewsletter. "...there is a resurgence of interest in offshore exploration in Sri Lanka, after a lapse of about 20 years. The main impetus is the success achieved on the Indian side of the Cauvery Basin, which straddles India and the north of Sri Lanka, where fields are in production and a significant discovery has been made close to the median line."

NTPC Ltd., India's largest power company, in December signed an agreement to build a 500 megawatt coal-fired power plant in the Sri Lankan port town of Trincomalee. The plant is expected to commence operations in 2011.

Surging crude oil prices raised Sri Lanka's oil import bill by 25 percent last year to $2.07 billion. Import costs have been boosted by a depreciating currency.

The Central Bank of Sri Lanka's last week maintained its 2007 growth forecast even as renewed fighting in the island's civil war and the highest interest rates in Asia slowed the pace of expansion in the fourth quarter.

To contact the reporter on this story: Anusha Ondaatjie in Colombo at anushao@bloomberg.net

-------------------------------------------------------------------------------------

Comment by a reader: Are Singhalese leasing out Tamil oil fields? Are they then going to use the oil and gas revenues to kill the Tamils? Don't forget that defense expenses for next year will be US$ 2 billion, while no oil will be pumped for another 10 years. Why should smart oil companies dish out hundreds of millions of dollars many years upfront without knowing if they would be allowed to take any oil home?

Tamils will never be like the Biafrans of 1969. Col. Ojukwu, once leader of the Biafran resistance, is today one of the richest Nigerians.

It is time that Tamils assert their rights to the mineral rights of the Tamil homeland and adjoining Seas. The mineral sands and huge deposits of limestone, which is used for the manufacture of cement, are our other mineral assets. These are in addition to the Ports, Airports and the 200 mile economic zone into the ocean. We do not know today what marine resources we will find in a 100 years' time within our boundaries.

Tamils cannot be passive and pussy-footing on our assets. Otherwise, we all will be screwed and the fight for a seperate state will be nothing but a wasted effort. We will end up like the Tea and Rubber plantation workers, who do not benefit fron the Tea and Rubber that is produced in those fertile lands and the toil and sweat of the workers.

--------------------------------------------------------------------------------------

Presentation on oil exploration in Mannar basin

by Daily News, Colombo, March 30, 2007

|

| Cauvery Basin |

PRESENTATION: The Government is preparing to offer exploration licences for oil and gas in the Mannar Basin since recent seismic data have shown that Sri Lanka has the potential for hydrocarbon accumulations. Sri Lanka may well be on the verge of developing an offshore oil and gas industry.

The question is, if Sri Lanka is to develop an offshore oil and gas industry how should the Government go about it?

The Ceylon Chamber of Commerce is organising a presentation by Dr. Neil de Silva, Director General of Petroleum Resources to educate the business community on Government plans to develop the oil and gas industry in Sri Lanka.

The presentation will also highlight new business opportunities related to oil and gas industry.

The presentation will be held on April 6 from 3.00-4.30 pm (including a Q and A session) at the Ground Floor Auditorium of The Ceylon Chamber of Commerce.

Dr. Neil De Silva is the Director General of Petroleum Resources. Dr. De Silva has a B.Sc (Hon) in Geology from the University of Ceylon and M.Sc and Ph.D. degrees from the Memorial University of Newfoundland in Canada.

[Sri Lanka Dept. of Fisheries & Acquatic Resources, accessed April, 2007]

[Sri Lanka Dept. of Fisheries & Acquatic Resources, accessed April, 2007]

He has a Diploma in Business Administration from the Dalhousie University in Halifax, Nova Scotia, Canada.

Since 1980, Dr. De Silva has worked as a petroleum geologist, petroleum geophysicist and an Exploration Manager.

Sri Lanka is totally dependent on imported fossil fuels and the escalating oil and gas prices have not only led to the increase in the cost of living but also the reduction of competitiveness of Sri Lankan exports.

Due to the high oil prices, Sri Lanka has been facing energy crises from time to time with serious repercussions on the Sri Lankan economy.

The development of the oil and gas industry will not only solve major problems in the power and energy sector but also have a spin off effect on the whole economy. The oil and gas industry has the potential to change the destiny of Sri Lanka.

-------------------------------------------------------------------------------------------------

US grants Sri Lanka $474,000 to develop upstream licensing rules

by Platts, Singapore, March 23, 2007

The United States has given Sri Lanka a grant of Sri Lanka Rupees 51 million ($474,000) to fund the development of an oil and gas regulatory system, the US embassy in Sri Lanka said in a statement last week.

The grant will help Sri Lanka transition from a consumer-driven to a production-oriented oil and gas regulatory structure, based on the Sri Lankan government's plans to open up promising offshore oil and gas blocks for exploration and development, the US embassy said. Sri Lanka plans to unveil its much-delayed maiden bidding round around mid-April, oil minister A H M Fowzie told Platts earlier.

Some eight blocks have been identified in the Mannar Basin close to India's Cauvery Basin, but Sri Lanka has already promised two of these to China and India.

The contracting round was originally scheduled for the third-quarter of 2006 but has faced several setbacks as the government changed tack mid-way on the acquisition of seismic data.

Lack of adequate human resources and supporting infrastructure also caused the delay.

The creation of a regulatory regime will contribute to Sri Lanka's nascent petroleum industry and reduce the nation's dependence on imports, the US embassy said. "A well-developed regulatory structure is essential to attracting and keeping high-quality investors in the oil sector," Robert O. Blake, US ambassador to Sri Lanka, said.

Barring some sporadic exploration activities in shallow waters along Sri Lanka's west coast in the 1970s and 80s, which yielded nothing, the south Asian country has seen almost no upstream activity.

But since 2001, with help from the Asian Development Bank, Sri Lanka began taking steps toward exploring its upstream potential and in October 2005 set up a Ministry of Petroleum Resources Development under the president's office to manage oil and gas exploration and production activity.

But since 2001, with help from the Asian Development Bank, Sri Lanka began taking steps toward exploring its upstream potential and in October 2005 set up a Ministry of Petroleum Resources Development under the president's office to manage oil and gas exploration and production activity.

The Mannar Basin, located between southwestern Sri Lanka and the Indian coastline in water depths ranging from 50 meters to more than 3,000 meters, lies immediately to the south of the Cauvery Basin, known for both oil and gas production in the Indian waters.

Sri Lanka currently relies on imports to meet all of its crude demand of around 42,000 b/d and 50% of its products demand of around 3.5 million mt/year (about 70,000 b/d).

------------------------------------------------------------------------------------------------------

Offshore back on agenda after Mannar basin rethink

from: Asian Oil & Gas

by: Dr. Ray Shaw

Friday, April 26, 2002

With newly acquired seismic data serving to dispel earlier suggestions that the Gulf of Mannar basin was devoid of rift basin architecture, the Sri Lankan government is gearing up for petroleum exploration of its offshore areas for the first time in almost 20 years. Dr Ray Shaw* summarises the current state of play.

A recent report sponsored by funding from the Asian Development Bank recommended new fiscal and legal frameworks be implemented as part of a major overhaul of Sri Lanka’s promotion of its upstream oil and gas potential.

The report, prepared by the School of Petroleum Engineering within the University of New South Wales (UNSW) based in Sydney, Australia, sets out a draft Petroleum Resources Act as well as the conclusions of a technical review of the petroleum prospectivity of the offshore areas.

Prepared in 2001, the draft Petroleum Resources Act was being considered by a cabinet committee at the time Sri Lankan president Chandrika Kumaratunga announced the proroguing of Parliament and new elections. Following December’s election of a new government under prime minister Ranil Wickremesingsinghe and the appointment of Karu Jayasooriya as minister for power and energy, it is expected that reconsideration and passage of the bill will be high on the agenda during the first part of this year.

Once adopted, a formal announcement will be made outlining details of the bidding round process. This is likely to take place during a workshop to be held in Colombo at which senior government and UNSW representatives will outline in detail key legal, fiscal and administrative aspects of the new Act and technical conclusions of the report.

Earlier exploration

From an exploration perspective Sri Lanka has been virtually ignored by the international upstream oil and gas community for nearly 20 years. Prior to Petro-Canada pulling out in 1984 there had been a number of forays, between 1966 and 1984, by both Western and Soviet entities, principally focused on exploration within the shallow offshore areas of the Cauvery basin located off the Jaffna Peninsula.

During this period some 18,000km of seismic data were recorded and seven wells drilled, of which four were structural tests. All were plugged and abandoned without encountering commercial hydrocarbons, although the three stratigraphic wells drilled by the Soviets on Mannar Island (Pesalai 1, 2 and 3), were reported to have encountered wet gas shows at several levels. In the Palk Strait region of the Cauvery basin, Marathon drilled the Palk Bay-1 and Delft-1 wells and Cities Service drilled Pedro-1. Cities Service also drilled Pearl-1 on the eastern flank of the Gulf of Mannar basin located to the south of the Adam’s Bridge high which separates the two basins.

Principal targets were sought by Marathon and Cities within Cretaceous sands across horsts and tilted fault blocks in the Palk Strait region. Interest here was kindled by a flow on test of 1488b/d from Cretaceous sands in the PH-9-1 well located just 30km to the north of the Pedro-1 structure, within Indian waters of the Cauvery basin.

It was this interest in pursuing PH 9-1 lookalikes in the nearby shallow waters of the Sri Lankan Cauvery basin that focused attention away from the comparatively much deeper water setting of the Gulf of Mannar basin. Only Cities Pearl 1 well tested the Gulf of Mannar basin and that well was located high up on the shelf, again in shallow waters. Although penetrating a thick sequence of Cretaceous sands, Pearl-1 failed to encounter any shows. Terminating prematurely in Late Cretaceous basalts, similar in age to basalts in Asamera’s Mannar 1,1A well drilled on the northwestern Indian counterpart side of the basin, Pearl-1 led to speculation that this basin may be underlain by oceanic crust and so lack any of the syn-rift sequences thought to host the likely source rocks of the Cauvery basin to its north.

Alternative viewpoint

Contradicting this view, the UNSW report concluded that the area holding the best potential in the offshore Sri Lankan region is the Gulf of Mannar basin. The Bay of Bengal margin side of the island, first thought to have good potential, appears to have been transform dominated and much of the syn-rift sequences may have been detached during the inception of seafloor spreading along this margin. Following interest by a number of seismic acquisition companies, TGS-Nopec was awarded a licence by the Ceylon Petroleum Corporation (the national oil and gas enterprise of Sri Lanka) to acquire the first reconnaissance seismic coverage across the deeper water portions of the Gulf of Mannar basin.

During June and July 2001, some 1100km of 2D seismic were recorded by TGS-Nopec and subsequently processed by WesternGeco. Their preliminary results, presented in Singapore at a Southeast Asia Petroleum Exploration Society (Seapex) conference last December, confirmed the UNSW view and have now encouraged moves by TGS-Nopec to acquire a much more elaborate survey of some 7000-8000km across the Gulf of Mannar basin during 2002.

The previously-undescribed Gulf of Mannar basin developed during at least two periods of rifting and associated continental breakup, as part of the multiphase fragmentation of Gondwanna during the Mesozoic.

The first phase began as a precursor to the commencement of seafloor spreading in what is now the oceanic Bay of Bengal. This was followed by a second phase of rifting associated with the detachment of Madagascar from the western side of the developing Indian sub-continent, culminating in a second breakup unconformity at the top of the Late Cretaceous.

Subsequently the Sri Lankan margins entered a phase of subsidence, driven by thermal contraction, which continued until uplift and a major period of regressive sedimentation began in the late Miocene.

TGS-Nopec data has confirmed up to at least six seconds of section lies above basement in the Gulf of Mannar basin. Sediments comprise four packages. The oldest package, Megasequence 1, was deposited during the initial syn-rift phase of basin development, prior to the commencement of seafloor spreading west of Sri Lanka within the Bay of Bengal. Megasequence 2 sediments were deposited during the rift and sag phase, after the commencement of seafloor spreading in the Bay of Bengal but before the onset of spreading about the West Indian Ridge. The boundary between Megasequences 1 and 2 coincides with an Albian unconformity, whereas a Late Cretaceous to Paleocene unconformity separates Megasequences 2 and 3. Megasequence 3 was deposited during a Tertiary sag phase of basin development, which terminated in the late Miocene following compression. Subsequent basin-wide regression resulted in deposition of Megasequence 4.

Petroleum geology

There are three potential source intervals. The first are associated with the Upper Gondwanna Group sediments which occur in outcrop both on the Indian and Sri Lankan landmasses. These are likely to be mainly terrestrial and associated with initial syn-rift development. Another source sequence is associated with the basal transgression over the Albian unconformity, and the third with the open marine Cretaceous sediments. On the basis of synthetic burial history modeling discrete hydrocarbon generation phases are envisaged both in the Late Cretaceous-Early Tertiary and again in the Late Tertiary.

Good clastic reservoir intervals are predicted in Megasequence 2, based on the results of the Pearl-1 well. Megasequence 3 contains good potential clastic reservoirs towards the base, immediately overlying the breakup unconformity and carbonate reservoir potential is also present in the Paleocene to middle Miocene section.

There are a wide variety of potential trapping mechanisms including horsts and tilted fault blocks and associated compactional drape. Regionally, compressionally-induced traps together with turbidite-related and carbonate stratigraphic traps are recognized, there being a major fairway along the basin-floor and lower slope of the Sri Lankan margin comprising at least three discrete stratigraphic intervals of stacked and interbedded turbidite and channel deposits, some up to 1.0 seconds thick. Several structures have associated flat spots, phase changes and amplitude bursts on the seismic sections, consistent with direct hydrocarbon indicators. These occur across a wide range of stratigraphic levels.

Conclusions

A review of pre-existing exploration data together with recently acquired new seismic data clearly dispels earlier interpretations that the Gulf of Mannar basin is devoid of rift basin architecture. It is now established as a basin containing thick syn-rift and post-breakup sedimentary infill. The Gulf of Mannar basin represents a new deepwater frontier region which has the indicia for hosting significant hydrocarbon accumulations.

* Dr Ray Shaw, team leader of the ADB-Sri Lanka Project, is with the University of New South Wales’ School of Petroleum Engineering. AOG readers requiring further details should contact either:

DTP Liyanaarachchi, exploration manager, Ceylon Petroleum Corporation, 5th Floor, Rotunda Tower, 109 Galle Road, Colombo 03; e-mail: cpcoilex@ceypetco.com.lk; tel: 94-1-437977. or Peter Baillie of TGS-Nopec, Level 5 MLC House, 1100 Hay Street, West Perth, WA 6005, Australia; e-mail: peterb@tgsnopec.com.au; tel: 618-94800000.

© 1996-2025 Ilankai Tamil Sangam, USA, Inc.